Both Xero and QuickBooks offer multiple tiers designed to fit different business sizes from small startups to larger enterprises. Xero simplifies the learning process through extensive educational resources like online classes while focusing on 24/7 customer support availability. This ensures that all financial data flows into one centralized place where it can be easily monitored and managed. Error Reduction in Financial RecordsManual accounting is prone to errors due to human involvement.

Streamlining OperationsThe combination of QuickBooks and Link My Books drastically streamlines operations for Amazon sellers. Sellers can use this information to adjust pricing, manage inventory more effectively, and optimize their marketing efforts. Ensure all documents are easily accessible and securely stored.

For instance, if benchmarking reveals that inventory turnover is slower than industry averages, a seller might consider strategies to enhance product visibility or adjust pricing models. Effective accounting software for Amazon sellers must be able to handle multi-currency transactions seamlessly, providing accurate currency conversion and reconciliations that reflect real-time exchange rates. The Ultimate Guide to Choosing the Best Accounting Software for Your Amazon BusinessAssessing Your NeedsBefore diving into the ocean of accounting software, it's crucial to evaluate your specific needs as an Amazon seller.

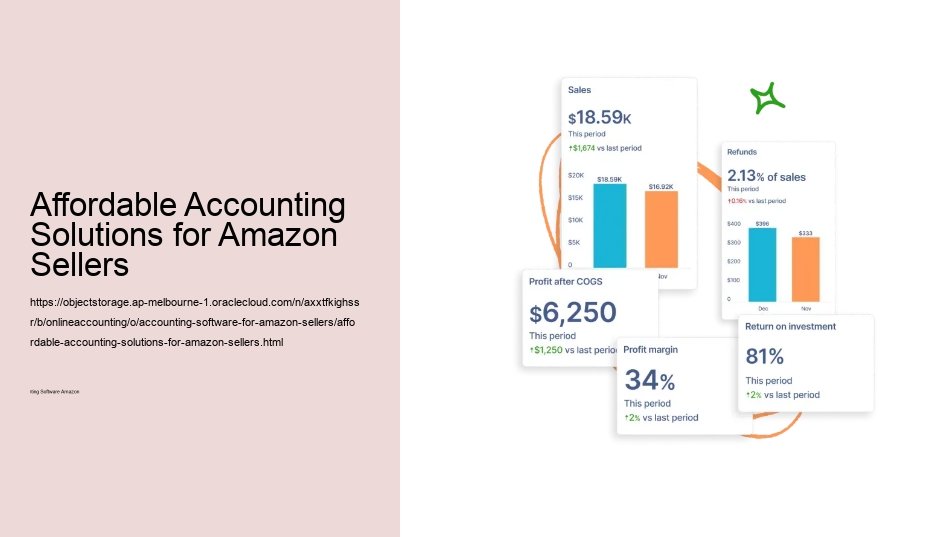

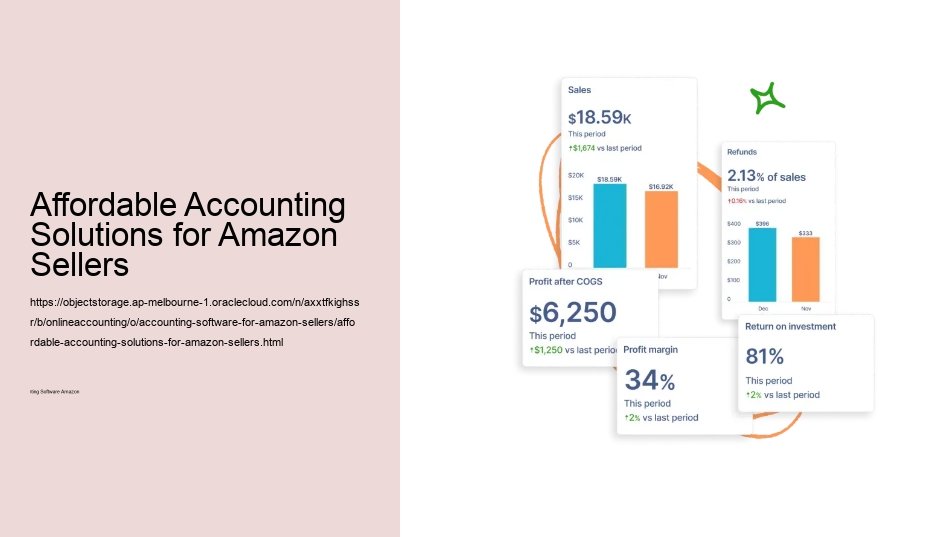

These reports can track sales trends, profitability per product line, seasonal fluctuations, and other key metrics essential for growing an Amazon business strategically.

Choosing the right accounting software equipped with specialized tools like Link My Books can transform an otherwise daunting task into a manageable one. In effect this means,The integration of specialized accounting software allows Amazon sellers to enhance operational efficiency and accuracy while focusing on scaling their businesses. Exploring Budget-Friendly Accounting Tools: Zoho Books vs Wave for Amazon SellersZoho Books: An Overview for Amazon SellersZoho Books is an accounting software that positions itself as a cost-effective solution for small to medium-sized businesses, including those operating on Amazon. Automated systems can handle complex calculations such as currency conversions, tax obligations across different regions (like VAT), and tracking fees or refunds associated with Amazon selling activities.

By linking these powerful accounting tools with your Amazon Seller account, you can automatically verify each transaction for tax purposes, create comprehensive invoices that break down sales, refunds, and fees, and match these perfectly within your financial records. These resources are crucial for users to get the most out of their accounting software capabilities. Evaluate the pricing plans against features offered-higher costs may be justified by advanced functionalities such as multi-currency support or integrated payroll services that simplify global transactions typical for Amazon sellers operating worldwide.

User Experience and SupportThe usability of any software is fundamental, especially when dealing with something as critical as your business's finances.

Choosing The Right Accounting SoftwareThere are several accounting software options available that cater specifically to Amazon sellers' needs, such as Xero and QuickBooks when used in conjunction with Link My Books. Each plan is designed to meet the varying needs and budgets of online sellers ensuring that there's an option for everyone without compromising on essential features. This not only saves time but also reduces errors associated with manual data entry.

This includes automated tax calculations and reconciliations which are vital for maintaining compliance with tax obligations. QuickBooks offers sophisticated analysis tools that help identify sales patterns and market trends.

For Amazon sellers utilizing Xero or QuickBooks, comprehensive customer support can assist in navigating the initial setup phases, ongoing management, and troubleshooting any issues that arise.

Access to community forums where users can exchange tips also enhances the overall user experience by fostering a collaborative environment for troubleshooting. Additionally, users benefit from extensive app integrations, enhancing capabilities in inventory management and forecasting which are vital for scaling an e-commerce operation. This not only saves time but also increases accuracy by minimizing manual data entry errors which are common when handling high volumes of transactions.

Each software solution presents distinct advantages tailored towards optimizing financial management within an Amazon selling context when integrated with Link My Books-the decision ultimately rests on aligning these factors closely with your operational goals. In effect this means,adopting specialized accounting software tailored for Amazon sellers represents a strategic investment in the scalability and efficiency of one's business operations.

Both Xero and QuickBooks offer extensive training resources and customer support. Advanced Reporting CapabilitiesAdvanced reporting is another key feature where customer support intersects significantly with software utilization.

In effect this meansFor Amazon sellers seeking effective solutions to manage their finances while minimizing errors and ensuring compliance with tax laws, using Xero integrated with Link My Books offers a compelling advantage. Automation reduces the need for extensive manpower dedicated to accounting tasks, thereby cutting down operational costs.

Similarly, understanding how profit margins stack up against peers can lead to targeted efforts in cost management or value-added services. It's not just about tracking money in and out; it's about leveraging detailed financial analytics for comprehensive benchmarking that informs strategic business decisions. US and Australian markets offer similar tiered pricing structures adjusted for local currency and market needs. Compliance Tools for Amazon Sellers This integration automates much of the data entry work typically associated with online sales.

Detailed Feature ComparisonXero offers features like easy bank matching, which automatically aligns your Amazon earnings with your bank records, VAT assistance tailored to UK tax rules, and a wide range of compatible apps. This includes detailed profit and loss statements, sales trends by product or category, and expenses breakdowns. Essential Features for E-CommerceE-commerce platforms like Amazon involve complex transactions that span across different countries, each with its unique currency.

Meanwhile, QuickBooks targets users who have basic accounting knowledge offering detailed tutorials and a community forum where users can interact with peers. In effect this means,For Amazon sellers looking at serious growth or those overwhelmed by manual accounting tasks, integrating Xero with Link My Books presents a powerful toolset tailored specifically towards managing e-commerce complexities efficiently. The software should seamlessly sync with Amazon's API to ensure that sales data, fees, inventory levels, and customer information are automatically updated and accurately reflected in your accounting records.

The user-friendly design ensures that even those new to accounting can navigate its interface effectively, while 24/7 online support stands ready to assist with any queries.

Fortunately, tools like Xero, a comprehensive cloud-based accounting software, combined with Link My Books, a platform designed to automate financial data from e-commerce channels, streamline the process significantly. Each tier offers increasing levels of functionality designed to match different business sizes and needs. In effect this means adopting a systematic approach combined with powerful tools ensures accurate bookkeeping practices that save time and mitigate risks related to financial mismanagement for Amazon sellers.21 . Streamlined Operations and ComplianceAnother significant advantage of using specialized accounting software is compliance assurance with tax regulations and financial standards.

Customizing Your Accounting Setup to Match Your Amazon Business StructureUnderstanding Your Amazon Business NeedsBefore customizing your accounting setup, it's crucial to understand the specific needs of your Amazon business. Such insights are crucial for Amazon sellers to understand their business's financial health and make informed decisions about future growth strategies. QuickBooks Online: Enhanced by Link My BooksSimilarly, QuickBooks Online serves as another powerful platform for Amazon sellers when paired with Link My Books.

Pricing Structure SpecificsUnderstanding the cost implications is essential when choosing any service platform. Furthermore, QuickBooks updates its system to stay compliant with the latest tax laws, providing peace of mind for sellers concerned about adhering to legal standards. QuickBooks' US pricing starts at $35/month escalating up to $235/month depending on additional features such as inventory management or advanced reporting capabilities.

Errors in VAT filings can lead to significant penalties, compounding the stress of financial management for Amazon sellers who are already dealing with competitive market pressures and logistical challenges. Whether it's handling multi-currency transactions smoothly or automating every sale down to the tax details without lifting a finger, this combination alleviates much of the stress associated with e-commerce finances allowing sellers more time to focus on expanding their business horizons. It's important to compare monthly fees against the suite of services each platform offers-sometimes spending a bit more can save you significantly in terms of time and manual effort.

Utilizing robust accounting software like Xero or QuickBooks integrated with Link My Books can significantly simplify these processes. In effect this means that leveraging tailored setups within recognized frameworks like Xero plus Link My Books offers significant advantages for streamlined operations in an e-commerce environment dominated by platforms such as Amazon. It provides real-time conversion and updates exchange rates automatically, ensuring that financial statements are always accurate.

Training and Educational ResourcesBesides direct support, another significant aspect is the availability of training resources provided by the software platforms. Zoho Books leads with more comprehensive features like automatic bank feeds, integrated GST billing, and multi-currency support which are crucial for growing businesses that engage in international sales.

Enhanced Accuracy and Time SavingsThe primary benefit of using automated systems like Xero combined with Link My Books is the assurance of accuracy in your financial records. Reliable support can help resolve issues quickly, minimizing downtime and ensuring continuous operation.

Both Xero and QuickBooks offer robust solutions, but their features cater to different needs. Software like Zoho Books presents a budget-friendly option but may lack certain advanced features provided by more expensive counterparts such as Sage or QuickBooks Advanced.

Audit, likewise referred to as book-keeping, is the process of recording and handling information regarding financial entities, such as businesses and companies. Bookkeeping measures the outcomes of an organization's financial tasks and conveys this details to a selection of stakeholders, including investors, financial institutions, administration, and regulators. Practitioners of accounting are known as accounting professionals. The terms "bookkeeping" and "financial coverage" are commonly used reciprocally. Bookkeeping can be divided right into several areas including financial accounting, management bookkeeping, tax accountancy and expense accounting. Monetary bookkeeping focuses on the reporting of a company's economic details, consisting of the preparation of financial statements, to the outside customers of the information, such as capitalists, regulatory authorities and distributors. Management accounting concentrates on the dimension, evaluation and reporting of details for internal use by monitoring to boost business operations. The recording of economic deals, to make sure that summaries of the financials might be presented in financial records, is known as accounting, of which double-entry accounting is the most typical system. Accounting details systems are made to sustain bookkeeping functions and relevant activities. Accountancy has existed in different types and levels of class throughout human history. The double-entry bookkeeping system in operation today was developed in middle ages Europe, specifically in Venice, and is usually credited to the Italian mathematician and Franciscan friar Luca Pacioli. Today, accounting is assisted in by accounting companies such as standard-setters, bookkeeping companies and expert bodies. Financial declarations are typically investigated by audit firms, and are prepared according to usually accepted audit principles (GAAP). GAAP is set by different standard-setting companies such as the Financial Bookkeeping Specification Board (FASB) in the United States and the Financial Reporting Council in the UK. Since 2012, "all major economic situations" have plans to merge towards or take on the International Financial Coverage Standards (IFRS).

.